The Best Longterm Care Insurance Companies

For instance, a 55-year-old couple can expect to pay about $2,500 per year in annual premiums for long-term care insurance. a 60-year-old couple would pay $3,500, but by 65 it would cost $7,000 and by 70 it would likely cost $14,000 or more per year. some tax deductions may be available depending on your age and state. The average yearly cost of a long-term care long term care insurance 70 year old policy is $1,400 for a single 65-year-old man and $2,100 for a single 65-year-old woman in good health. “[long-term care insurance] is not like auto.

Apr 16, 2020 · valley view residence long-term care (541 finch st. ): 2 deaths bendale acres long-term care (2920 lawrence ave. e. ) ehatare nursing home (40 old kingston rd. ). Among 65-year-old americans, 52% eventually will develop a disability and will need long-term care services, according to a study revised in 2016 by the urban institute and the u. s. department of.

If You Are 70 Can You Still Get Long Term Care Insurance

If you live into your 80s and 90s, chances are you will need long-term healthcare. this type of care is typically not covered by medicare, medicaid or private health insurance. that's why over 10 if you live into your 80s and 90s, chance. Looking for florida automobile insurance? prepare yourself for the hefty premiums you're likely to pay and discover a few money-saving tips with this quick guide. Middle-income americans face a tough choice about whether to buy long-term care insurance. aging can be an expensive process, and few costs are more daunting than long-term care. people who need long-term care can end up spending months or.

Your guide to term life insurance.

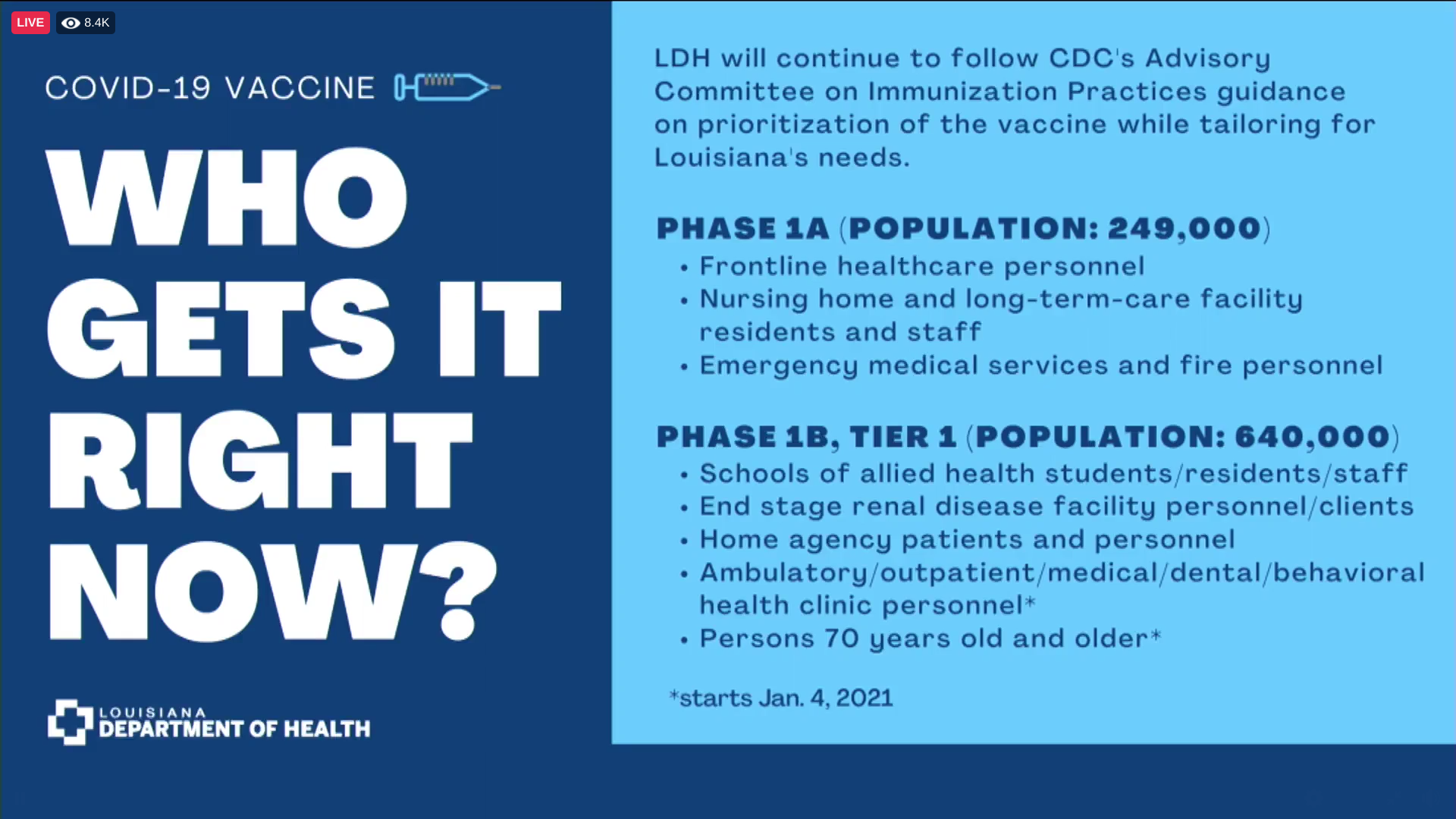

Insurance is one of the most crucial things to have. having insurance can protect you and your family from surprises that could make you broke. because of this, everyone should have insurance. however, many people can be confused by the dif. Long-term care insurance is a term you should know. here's what it is. elevate your bankrate experience get insider access to our best financial tools and content elevate your bankrate experience get insider access to our best financial too. Mar 04, 2021 · age 61 to 70—$4,350. age 71 or over—$5,430. you can't deduct payments for a qualified long-term care insurance contract for any month in which you were eligible to participate in a long-term care insurance plan subsidized by your employer or your spouse's employer. she changes to family coverage only to add her 26-year-old.

See more videos for long term care insurance 70 year old. Long term care insurance is issued based on the insurance company's medical underwriting. the insurance company will check your medical history and require that you take medical exams. only after you passed these qualifications will you be issued a policy. at the age of 70, passing these qualifications may be hard. Dec 09, 2016 · those who have an existing life insurance policy or an annuity may be able to use a 1035 exchange to buy long-term care insurance tax-free. "it's really the only way to get money out of an annuity.

Mar 09, 2021 · although we all hope we will never need it, 20% of 65-year-olds will need long-term care for five years or more as they age. long-term care insurance provides coverage to help pay for assistance with basic daily living activities like dressing, bathing, or eating if you cannot care for yourself due to a disability or illness. For instance, a 55-year-old couple can expect to pay about $2,500 per year in annual premiums for long-term care insurance. a 60-year-old couple would pay $3,500, but by 65 it would cost $7,000 and by 70 it would likely cost $14,000 or more per year. some tax deductions may be. The aarp long term care insurance plan may not stack up to other options on the private market. home care: new york life's policies often limit home care (where you're most likely to actually use your coverage) to 80%. that can add up to thousands of dollars a year in lost benefits versus competitive offerings from massmutual or mutual of omaha. Aging baby boomers, and even younger folks looking to make a plan for their future, may look to long-term care insurance to try and help offset the rising costs of care.

The average annual long-term care insurance premium for a 60-year-old couple is around $3,400 (or about $283 per month). 4 as far as the payout, the typical long-term insurance policy provides a benefit of $160 per day for nursing home care for a set number of years (three is most common). 5 plus, you can add an inflation rider that increases. Your employer can tell you the cost of the insurance, the date by which you must pay, and the manner in which payment must be provided. is state continuation similar to cobra coverage? yes, but cobra coverage is required of employers with 20 or more employees. Jan 29, 2021 · sr22 insurance companies can long term care insurance 70 year old charge a one-time filing fee, generally it is $25, and that is the standard sr22 insurance cost. however, the violation that resulted in an sr22 requirement will affect your auto insurance premium. in short, it’s your infraction -not the sr22 -that will hike up your rates. Sep 02, 2018 · the long-term care insurance price index (ltcip) for 2018 finds that a 60-year-old couple who buy a new long-term care insurance policy will pay about $3,490 in their first year.

What Is Longterm Care Insurance Money

A comprehensive guide to costs, coverage and whether it's right for you. many companies featured on money advertise with us. opinions are our own, but compensation and in-depth research determine where and how companies may appear. learn mo. Long-term care insurance covers things not normally covered by regular medical insurance. this includes nursing home, assisted living or home care for those who need it due to chronic conditions like dementia or other disabilities. elevate. Long-term care insurance pays or reimburses you for long-term care costs. you may have either a daily benefit like $180 per day or a monthly benefit like $5,000 per month. policies typically cover care in nursing homes, at home, in assisted living facilities, and at adult daycare centers. The type of life insurance you buy is a big decision, and there are a couple of different kinds from which to choose. term life insurance is a popular option for long term care insurance 70 year old many, mainly because it's affordable and uncomplicated. get the facts about te.

Sep 16, 2019 · for instance, according to the industry group american association of long-term care insurance, a 65-year-old couple can purchase a policy for $4,800 per year. Certain federal workers are facing a big hike in long-term care premiums. stay calm and explore other options. federal employees and retirees who signed up for the federal long term care insurance program may experience a rise in their bloo. Long-term care insurance (ltci) is different from traditional health insurance because it is designed to cover your long-term care needs, support, and services when the inevitable impact of aging or acquired disability gets to you. it includes custodial and personal care whenever and wherever you plan to receive care, be it in your own home, nursing facility, or a community organization.

Los angeles, ca aug 5, 2015 finding long term care insurance coverage after age 70 is difficult as leading insurers scrutinize health and most stop issuing new policies after age 75. a new video posted by a trade group explains an option worth considering. “our phone rings regularly with seniors in their 70s or their adult children who are looking for long term care insurance,” explains jesse slome, director of the american association for long-term care insurance (aaltci). If you are to provide for your loved ones after your death, it's a smart idea to purchase life insurance. term life and whole life insurance are two of the most common options. it's important to understand the difference between the two pro.

0 komentar:

Posting Komentar